by Ben Spiers

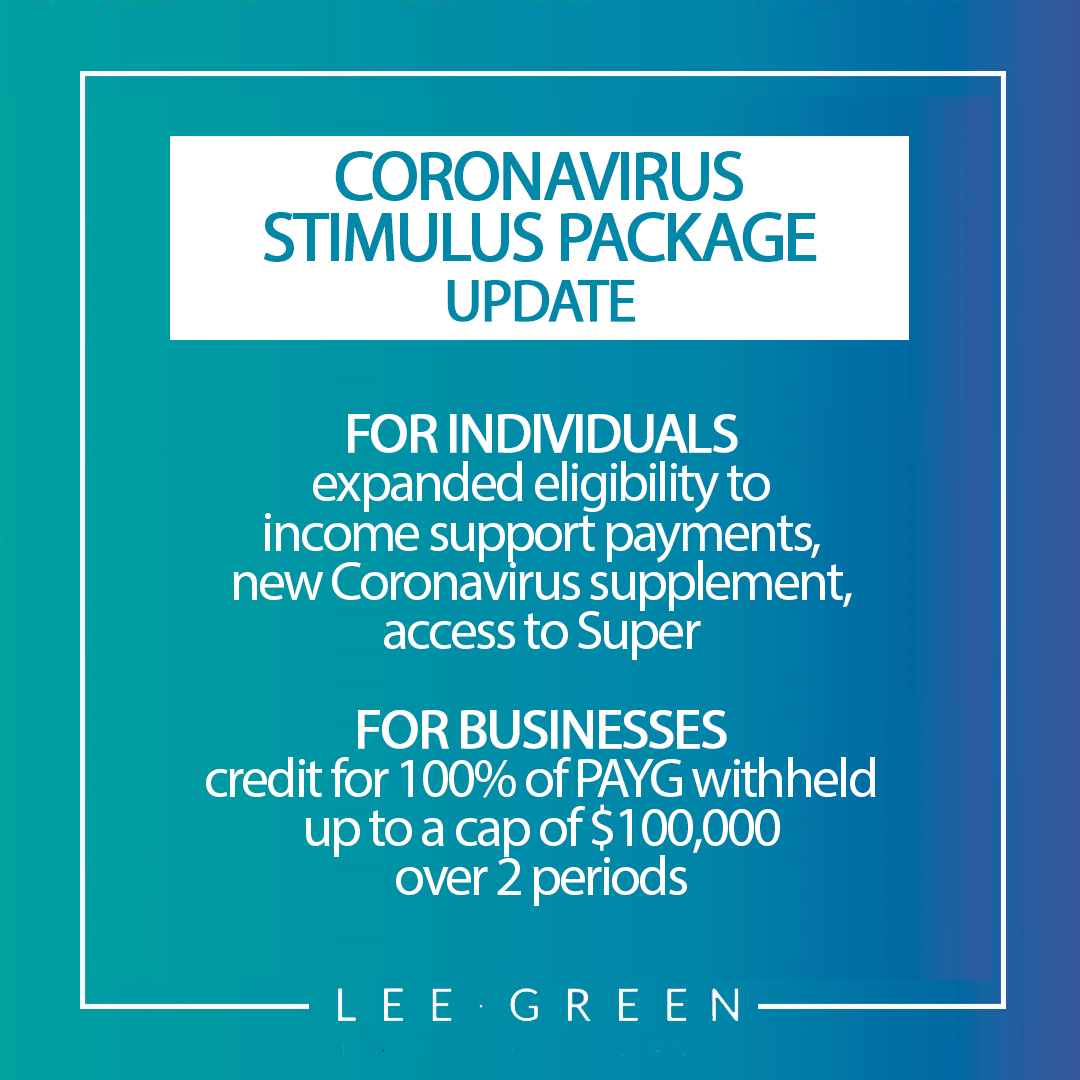

The current Coronavirus (COVID-19) pandemic is creating an economic situation that is unprecedented. Businesses and individuals across the country will be significantly impacted by this for many months to come. The government has now released the second stage of its economic response to the Coronavirus, please see the below summary of the updated package.

At Lee Green we are committed to working with you to support you through this difficult time. Our services will continue, and our staff will be available to provide advice and guidance and answer any questions you may have around the economic assistance packages and any other matters. We are available and contactable by email and social media channels.

By Maryna Prodanovski, Audit Manager

The new AASB 16 Leases standard is now effective. It replaces IAS 17 Leases for reporting periods beginning on or after 1 January 2019. There have been several pronouncements released to address accounting for leases and it can be challenging determining what is current methodology and what is applicable for trading companies versus Not-for-Profit entities.

by Mike Sweeney

Update - Legislation passed in February 2019 to extend Single Touch Payroll (STP) to employers with 19 or fewer employees starting from 1 July 2019. Small employers (5-19 employees) will need to begin reporting by 30 September 2019 but can begin reporting early if already using payroll software which offers STP. Deferrals past 30 September 2019 can also be applied for from the ATO. Micro Employers (1-4 employees) not currently using STP enabled software will have the option of reporting quarterly instead of each time payroll is run. Flexible reporting options are also available for employers with closely held payees (eg family members working in a business). More information on STP and reporting requirements and options can be found here https://www.ato.gov.au/Business/Single-Touch-Payroll/What-is-STP

Lee Green has reviewed the low ($10 or less per month) and no cost STP software solutions listed on the ATO website and can provide advice on which option will best suit your business. Lee Green may also be able to report through STP on your behalf. Please call us on (08) 8333 3666 or email us for any STP queries.

Single Touch Payroll (STP) starts from 1 July 2018 for employers with 20 or more employees and will be expanded to include employers with 19 or less employees from 1 July 2019. STP will require employers to report salary and wages, allowances, deductions, tax and superannuation to the ATO each time you pay employees in line with your current pay cycle.

Employers will require STP ready software and those with STP compliant software can choose to report before 1 July 2019. Most employers will find that commonly available commercial software solutions will be compliant however we recommend that you check with your provider to ensure your software is ready by the relevant start date.