by Ben Spiers

The current Coronavirus (COVID-19) pandemic is creating an economic situation that is unprecedented. Businesses and individuals across the country will be significantly impacted by this for many months to come. The government has now released the second stage of its economic response to the Coronavirus, please see the below summary of the updated package.

At Lee Green we are committed to working with you to support you through this difficult time. Our services will continue, and our staff will be available to provide advice and guidance and answer any questions you may have around the economic assistance packages and any other matters. We are available and contactable by email and social media channels.

Individuals:

The Government is temporarily expanding eligibility to income support payments and establishing a new, time-limited coronavirus supplement to be paid at a rate of $550 per fortnight. This supplement will be paid to both existing and new recipients of the eligible payment categories. These changes will apply for the next six months. Individuals receiving a range of income support payments will be eligible for this assistance. Click here for more information https://treasury.gov.au/sites/default/files/2020-04/Fact_sheet-Income_Support_for_Individuals.pdf

Temporary Early Access to Superannuation:

While superannuation helps people save for retirement, the Government recognises that for those significantly financially affected by the Coronavirus, accessing some of their superannuation today may outweigh the benefits of maintaining those savings until retirement. Eligible individuals will be able to apply online through MyGov to access up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation). There are strict eligibility criteria around this, so click here for more information https://treasury.gov.au/sites/default/files/2020-05/Fact_sheet-Early_Access_to_Super.pdf

Support for Retirees:

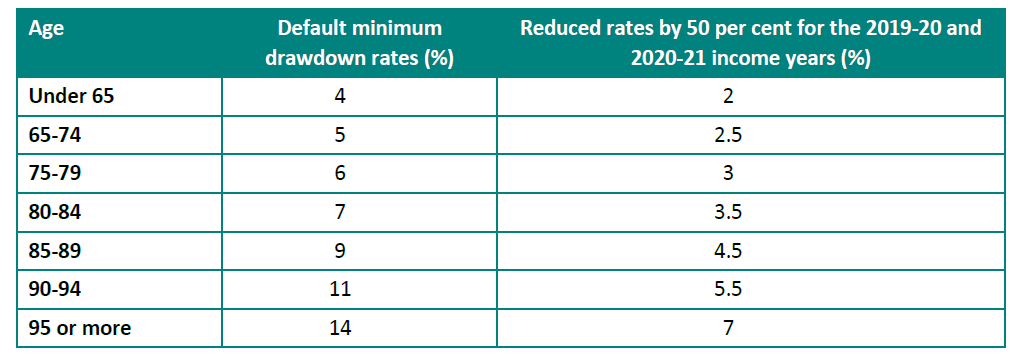

The Government is temporarily reducing superannuation minimum drawdown requirements for account-based pensions and similar products by 50 per cent for the 2019-20 and 2020-21 income years. The Government is also reducing both the upper and lower social security deeming rates by a further 0.25 percentage points in addition to the 0.5 percentage point reduction to both rates announced on 12 March 2020.

Temporary Reduction in Superannuation Minimum Drawdown Requirements:

This measure will benefit retirees with account-based pensions and similar products by reducing the need to sell investment assets to fund minimum drawdown requirements. The reduction applies for the 2019-20 and 2020-21 income years.

Households:

The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders. Around half of those that benefit are pensioners. These payments will support households to manage the economic impact of the Coronavirus.

- The first payment (announced on 12 March 2020) will be available to people who are eligible payment recipients and concession card holders at any time from 12 March 2020 to 13 April 2020 inclusive.

- The second payment will be available to people who are eligible payment recipients and concession card holders on 10 July 2020.

A person can be eligible to receive both a first and second support payment. However, they can only receive one $750 payment in each round of payments, even if they qualify in each round of the payments in multiple ways. The payment will be exempt from taxation and will not count as income for the purposes of Social Security, Farm Household Allowance and Veteran payments.

https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Payments_to_support_households_0.pdf

Sole Traders & Businesses

For individuals and businesses that are paying quarterly tax instalments (PAYGI), when lodging the March activity statement, you can vary the instalment to nil, and access a credit for amounts paid in the September and December 2019 quarters. This is particularly useful if you are experiencing a drop in income for the April-June 2020 period and you expect your tax liability to be reduced as a result of this.

Whilst this is available to all and can provide immediate cashflow, take care around this as it may result in a tax liability when lodging your 2020 tax return. If you need some guidance or tax planning calculations around this, please let us know.

Cashflow Assistance for Businesses:

The Government is providing up to $100,000 to eligible small and medium sized businesses, and not-for-profits (including charities) that employ people, with a minimum payment of $20,000. These payments will help businesses’ and not-for-profits’ cash flow so they can keep operating, pay their rent, electricity and other bills and retain staff. This is an upgrade from the previous announcement on 12 March 2020 which had $25,000 and $2,000 limits.

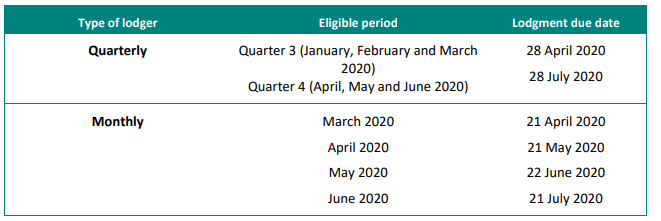

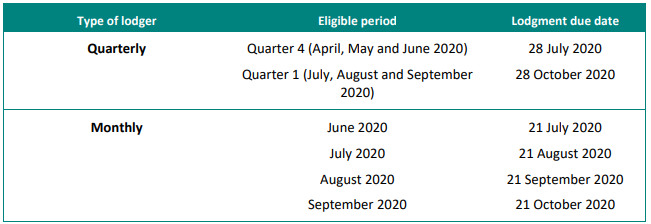

The payments are split across 2 periods, with the limits being $50,000 and $10,000 for each period.

Period 1:

Period 2:

Access to the assistance is via the lodgment of activity statements for the relevant periods. The amount that you are entitled to will first be applied as a credit to the activity statement account, and If applicable, refunded by the ATO within 14 days.

Monthly Lodgers:

- On lodgment of March activity statement, a credit of 300% of the PAYGW reported for March will be applied, up to the $50,000 limit

- Credits of 100% of the PAYGW will be applied to April, May & June lodgments up to $50,000

- For the June lodgment, any remaining credit up to the $50,000 will be applied, plus 25% of the total amount received in the March-June 2020 period

- Additional payments equal to 25% of the amount received in the March-June 2020 period will be applied to the July, August and September 2020 lodgments

Quarterly Lodgers:

- On lodgment of the March and June activity statements, a credit of 100% of the PAYGW reported for the March & June quarters will be applied, up to the $50,000 limit

- Additional payments equal to 50% of the amount received in the March and June quarters will be applied to the June and September quarter lodgments.

Key Points:

- Cashflow assistance measures apply to small and medium sized businesses and NFP’s with an aggregated turnover under $50 million that employ workers and were active prior to 12 March 2020

- For small withholders, or those business that don’t withhold any PAYGW (but still pay wages) will receive a minimum amount of $10,000 for the initial and additional payments.

- The access to the assistance requires lodgment of activity statements. The assistance will be a credit to the integrated account and will be paid by the ATO in the event of a refund.

More information and examples can be found here: https://treasury.gov.au/sites/default/files/2020-04/fact_sheet-boosting_cash_flow_for_employers.pdf

Support for Businesses Employing Apprentices & Trainees:

The Government is supporting small business to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50 per cent of the apprentice’s or trainee’s wage for 9 months from 1 January 2020 to 30 September 2020. Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer that employs that apprentice. Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

This subsidy needs to be applied for from early April 2020. For further information on how to apply for the subsidy, including information on eligibility, contact an Australian Apprenticeship Support Network (AASN) provider.

Supporting Business Investment:

There are 2 separate measures that will support business investment going forward, including;

- Increasing the instant asset write-off

- Accelerated depreciation deductions

Increasing the Instant Asset Write-Off:

The Government is increasing the instant asset write-off (IAWO) threshold from $30,000 to $150,000 and expanding access to include all businesses with aggregated annual turnover of less than $500 million (up from $50 million) until 30 June 2020. The annual turnover threshold for businesses is increasing from $50 million to $500 million. This proposal applies from announcement until 30 June 2020, for new or second-hand assets first used or installed ready for use in this timeframe.

Accelerated Depreciation Deductions:

The Government is introducing a time limited 15 month investment incentive to support business investment and economic growth over the short-term, by accelerating depreciation deductions. The key features of the incentive are:

- benefit — deduction of 50 per cent of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost;

- eligible businesses — businesses with aggregated turnover below $500 million; and

- eligible assets — new assets that can be depreciated under Division 40 of the Income Tax Assessment Act 1997 (i.e. plant, equipment and specified intangible assets, such as patents) acquired after announcement and first used or installed by 30 June 2021. Does not apply to second-hand Division 40 assets, or buildings and other capital works depreciable under Division 43.

Applies to eligible assets acquired after announcement and first used or installed by 30 June 2021.

There are other assistance packages provided by the Government, so if you need any further information about your specific circumstances, please contact us or go to The Treasury website https://treasury.gov.au/coronavirus.

This information is current at the time of publication 23/3/2020 and further updates may have occurred since that date. Please contact us for the latest information or refer to https://treasury.gov.au/coronavirus