by Ben Spiers, Director.

The 2022-23 Budget announced by the Government on Tuesday 29th March was primarily focussed at providing additional assistance to individuals considering the rising cost of living. There were many changes that will apply to Business, Individuals, Aged Care, Super and Taxation, but here is a summary of the key announcements.

Reduction in Fuel Excise

One of the key announcements that will affect almost everyone was the temporary 50% reduction in fuel excise until 28th September 2022. This reduction will reduce the fuel excise from 44.2cents per litre to 22.1 cents per litre for petrol and diesel. Other fuels (except aviation fuels) will also have a 50% reduction in the fuel excise.

Individuals

There were no major tax changes for individuals, with the reduction in individual tax rates still scheduled to apply from 1 July 2024. The superannuation guarantee will increase from 10% to 10.5% from 1 July 2022 as announced in previous years.

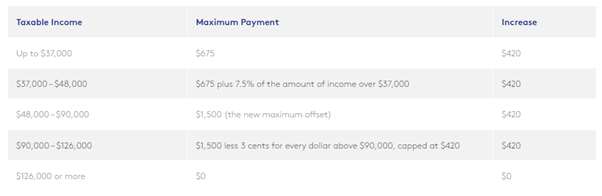

This Budget provided an increase of $420 to the Low and Middle Income Tax Offset (LMITO) up to a maximum of $1,500 per individual (previously $1,080). The same thresholds apply as in prior years (as per the table below provided by our friends at Saward Dawson), with the LMITO applicable to those individuals with income under $126,000. Currently, this tax offset is scheduled to finish on 30/6/2022, however it may be extended.

An additional tax-free support payment of $250 will be made to all eligible individuals in April 2022 to assist with the cost of living pressures. There is no application process required for this as it will be paid to those already receiving the following payments.

- Age Pension

- Disability Support Pension

- Parenting Payment

- Carer Payment

- Carer Allowance

- Jobseeker

- Youth Allowance

- Austudy and Abstudy living allowance

- Commonwealth Senior Health Card holders and

- Several other payments

Individuals will be able to claim a tax deduction for the costs of taking a COVID-19 test to attend their workplace. The deduction will be available to individuals where they incur the cost or to the business where they are providing tests to employees. No Fringe Benefits Tax will be incurred by the business.

Businesses

The Government continues to encourage businesses to reinvest in their equipment and systems. The temporary full expensing continues to 30 June 2023 and this Budget introduces two new measures to support investment by small businesses. An extra 20% deduction will be available on external training courses provided to upskill employees, as well as business expenses that support digital and technology adoption. This is intended to cover training courses supplied by entities registered in Australia as well as cyber security systems, cloud-based software, or portable payment devices.

One of our specialties is software conversions and app integrations, so get in touch with us to discuss further how you can utilise these opportunities to streamline your business.

Superannuation

Thankfully, there are no major changes to Superannuation. The contribution caps are to continue at the same rate for FY23, being a $27,500 concessional cap and $110,000 non-concessional cap. The Budget proposed an extension to the reduced minimum drawdown rates for Pensions for FY23. This of course still needs to be passed as law, so keep an eye out for our Superannuation special in June which will advise the upcoming rates and thresholds for FY23 as well as cover some of the other changes that have recently passed as law from the previous Budget.

There are many other announcements that came out of the Budget, so naturally if there is anything that you wish to discuss further or get clarification on, feel free to get in touch with your usual Lee Green contact.

This information is current at the time of publication and further updates may have occurred since that date. Please contact us for the latest information.