As the new financial year begins, our minds here at Lee Green turn to tax! Though it may be some time before you have all the information needed for the preparation of your individual tax return, we have provided below our handy Tax Return Checklist to help you along the way.

Once you have compiled all the information required, please get in touch with us to make an appointment.

Some important things to note on the changes to how your income information may be provided for the 2018-19 financial year:

- If your employer is reporting through Single Touch Payroll, your income statement should be ‘tax ready’ before we can lodge your return. Your employer has until 31 July to finalise payroll data and submit it as tax ready.

- If you receive a PAYG Payment Summary, your employer has until 14th July to provide it to you

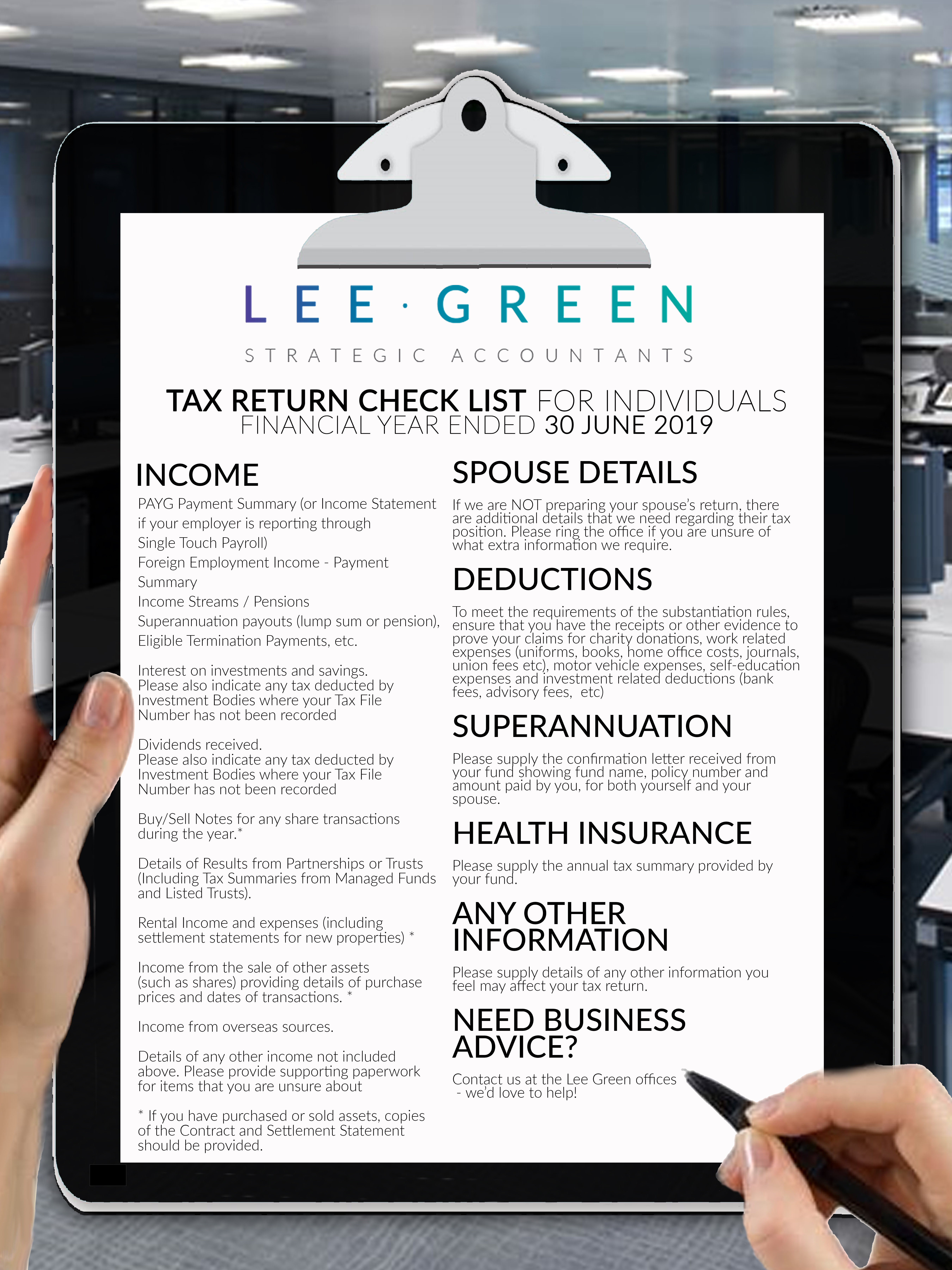

TAX RETURN CHECKLIST FOR INDIVIDUALS

INCOME

- PAYG Payment Summary (or Income Statement if your employer is reporting through Single Touch Payroll)

- Foreign Employment Income – Payment Summary

- Income Streams/Pensions

- Superannuation payouts (lump sum or pension), Eligible Termination Payments, etc.

- Interest on investments and savings. Please also indicate any tax deducted by Investment Bodies where your Tax File Number has not been recorded

- Dividends received. Please also indicate any tax deducted by Investment Bodies where your Tax File Number has not been recorded

- Buy/Sell Notes for any share transactions during the year.*

- Details of Results from Partnerships or Trusts (Including Tax Summaries from Managed Funds and Listed Trusts).

- Rental Income and expenses (including settlement statements for new properties) *

- Income from the sale of other assets (such as shares) providing details of purchase prices and dates of transactions. *

- Income from overseas sources.

- Details of any other income not included above. Please provide supporting paperwork for items that you are unsure about

* If you have purchased or sold assets, copies of the Contract and Settlement Statement should be provided.

SPOUSE DETAILS

If we are NOT preparing your spouse’s return, there are additional details that we need regarding their tax position. Please ring the office if you are unsure of what extra information we require.

DEDUCTIONS

To meet the requirements of the substantiation rules, ensure that you have the receipts or other evidence to prove your claims for charity donations, work related expenses (uniforms, books, home office costs, journals, union fees etc), motor vehicle expenses, self-education expenses and investment related deductions (bank fees, advisory fees, etc)

SUPERANNUATION

Please supply the confirmation letter received from your fund showing fund name, policy number and amount paid by you, for both yourself and your spouse.

HEALTH INSURANCE

Please supply the annual tax summary provided by your fund.

ANY OTHER INFORMATION

Please supply details of any other information you feel may affect your tax return.

If you have been happy with the service we provide and have a friend or associate who needs accounting services, please recommend us. We would be pleased to provide them with the same high level of service we provide to all our existing clients.

Need Business Advice? Contact Us